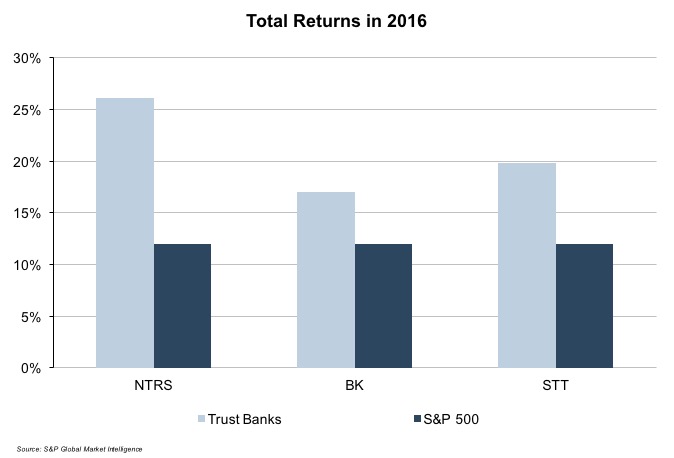

All three publicly traded trust banks (BNY Mellon, State Street, and Northern Trust) outperformed the market in 2016, continuing their upward trajectory over the last few years but still lagging the broader indices since the financial crisis of 2008 and 2009. Placing this recent comeback in its historical context reveals the headwinds these businesses have been facing in a low interest rate environment that has significantly compressed their money market fees and yields on fixed income investments. Their recent success may therefore be more indicative of a reversion to mean valuation levels following years of depressed performance rather than a sudden surge of investor optimism regarding future prospects. Further, pricing improvements for this group appear to be more relative to an improved banking environment than a change in circumstances for trust services.

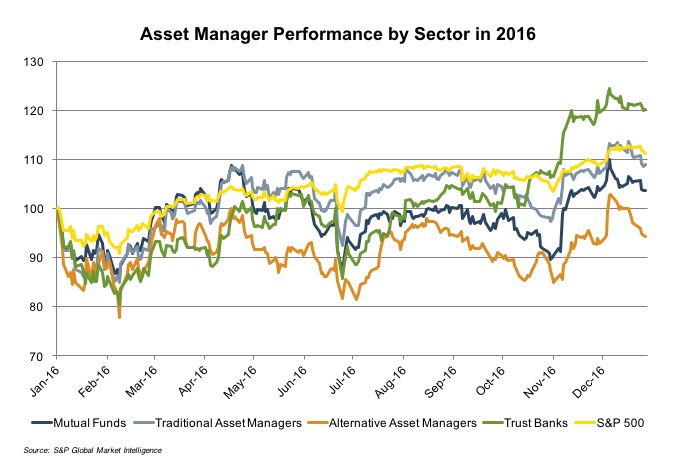

Still, in recent quarters, most trust bank stocks outperformed other classes of asset managers like mutual funds and alternative investors that endured a rocky 2016 as passive products and indexing strategies continued to gain ground on active management. The steepening yield curve portends higher NIM spreads and reinvestment income, and the market has responded accordingly – our trust bank index gained 20% for the year, besting the broader indices and all other classes of asset managers.

Still, in recent quarters, most trust bank stocks outperformed other classes of asset managers like mutual funds and alternative investors that endured a rocky 2016 as passive products and indexing strategies continued to gain ground on active management. The steepening yield curve portends higher NIM spreads and reinvestment income, and the market has responded accordingly – our trust bank index gained 20% for the year, besting the broader indices and all other classes of asset managers.

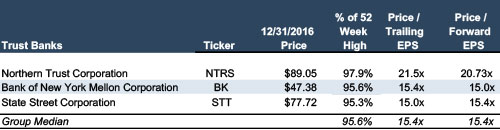

So have these securities gone from oversold to overbought? A quick glance at year-end pricing shows the group valued at 15x (forward and trailing) earnings with the rest of the market closer to 25x, so that alone would certainly suggest they aren’t yet too aggressively priced. Still, the three companies are all trading within 5% of their 52 week high (and all-time high for that matter), so it’s hard to say they’re really all that cheap either.

So have these securities gone from oversold to overbought? A quick glance at year-end pricing shows the group valued at 15x (forward and trailing) earnings with the rest of the market closer to 25x, so that alone would certainly suggest they aren’t yet too aggressively priced. Still, the three companies are all trading within 5% of their 52 week high (and all-time high for that matter), so it’s hard to say they’re really all that cheap either.

So if you’re looking for mean reversion within the sector then alternative asset managers might be your best bet, though we’d be remiss not to point out the inherent risks associated with some of these businesses.

So if you’re looking for mean reversion within the sector then alternative asset managers might be your best bet, though we’d be remiss not to point out the inherent risks associated with some of these businesses.

Mercer Capital's RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.