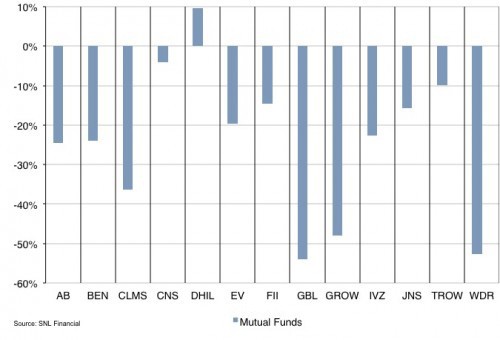

One streak that remains, albeit less reportedly, is passive funds’ dominance over their active counterparts over the last year. According to Morningstar, active funds endured $268 billion in net outflows over this period while their passive counterparts gained $382 billion in client assets. These dynamics are problematic for many mutual fund companies that rely on active equity products with higher fee schedules and profit margins. As a result, most publicly exchanged mutual fund companies are trading in bear market territory while the market has flat lined over the last year.

Active fund outflows are not only attributable to the rise in popularity of low-cost ETF strategies, but also sector-wide underperformance against their applicable benchmarks. Through the first two months of 2016, just 28% of large cap mutual fund managers are beating their benchmarks (27% for all of 2015) and only 1% posted positive returns, according to a Goldman Sachs study. Both individual and institutional investors are now more inclined to shun active managers for cheaper, more readily available products, particularly when performance suffers. Many active managers and mutual funds have responded by cutting fees or offering their own passive products to stem the outflows, but this has adversely affected their revenue yields and profitability.

Russel Kinnel of Morningstar elaborates on this trend in his recent article, “It’s Flowmegeddon! Outflows add to the challenges facing active stock fund managers.”

Active fund outflows are not only attributable to the rise in popularity of low-cost ETF strategies, but also sector-wide underperformance against their applicable benchmarks. Through the first two months of 2016, just 28% of large cap mutual fund managers are beating their benchmarks (27% for all of 2015) and only 1% posted positive returns, according to a Goldman Sachs study. Both individual and institutional investors are now more inclined to shun active managers for cheaper, more readily available products, particularly when performance suffers. Many active managers and mutual funds have responded by cutting fees or offering their own passive products to stem the outflows, but this has adversely affected their revenue yields and profitability.

Russel Kinnel of Morningstar elaborates on this trend in his recent article, “It’s Flowmegeddon! Outflows add to the challenges facing active stock fund managers.”

“The simple answer to this riddle is competition from exchange-traded funds. ETFs have gained the upper hand in the active/passive debate, even over open-end index funds, which generally offer comparable cost benefits. More advisors are switching to ETF-focused strategies, and, when they get a new client, they quickly sell the weakest performing active funds—possible all the actively managed funds—in the client’s current portfolio. Self-guided investors are moving to ETFs, too.”

As Mr. Kinnel notes, these redemptions from active funds wouldn’t be so alarming in a bear market, but we’ve come a long way since the Financial Crisis. This current trend is about investor preferences not investor paranoia.

On balance, passive funds appear primed to continue their dominance over active management, but we still question the sustainability of this trend over the long run. While fees are likely to continue their descent over time, it is hard to imagine that passive investing will completely replace active management. Such a scenario could lead to significant mispricing in the securities markets, which would be fertile ground for enterprising investors and mutual funds. While we’re more bullish on the prospects of Golden State and Barca this season, we haven’t completely ruled out active managers in the ongoing quest for investor capital and advisory fees.