[caption id="attachment_12679" align="aligncenter" width="349"]

Photo Credit: Gus's Fried Chicken[/caption]

One of my favorite pastimes is sampling the amazing food Memphis has to offer. Many of the best restaurants are located in buildings that are unassuming – or sometimes downright disconcerting. I am a little hesitant about walking down back streets and into old buildings to find my next meal, but I find comfort in the reviews of others. With its Styrofoam plates and 40 ounce bottles of beer, Gus’s World Famous Fried Chicken may not seem very promising, but the reviews are excellent … “lurking below that crunch is a subterranean flesh so moist and tender that it almost defies reality.” How could you not give it a try?

We often rely on the reviews of experts for decisions as trivial as where to eat lunch. When it comes to investing, we pay even more attention to what the experts say.

It caught investors’ attention when Warren Buffet further increased his stake in Phillips 66 from 78.782 million shares as of June 30, 2016 to 79.6 million as of August 30, 2016. He now has invested over $6 billion in Phillips 66 and owns almost 15% of Phillips’ available shares. His recent move has sparked a lot of questions regarding what Warren Buffet was thinking.

Photo Credit: Gus's Fried Chicken[/caption]

One of my favorite pastimes is sampling the amazing food Memphis has to offer. Many of the best restaurants are located in buildings that are unassuming – or sometimes downright disconcerting. I am a little hesitant about walking down back streets and into old buildings to find my next meal, but I find comfort in the reviews of others. With its Styrofoam plates and 40 ounce bottles of beer, Gus’s World Famous Fried Chicken may not seem very promising, but the reviews are excellent … “lurking below that crunch is a subterranean flesh so moist and tender that it almost defies reality.” How could you not give it a try?

We often rely on the reviews of experts for decisions as trivial as where to eat lunch. When it comes to investing, we pay even more attention to what the experts say.

It caught investors’ attention when Warren Buffet further increased his stake in Phillips 66 from 78.782 million shares as of June 30, 2016 to 79.6 million as of August 30, 2016. He now has invested over $6 billion in Phillips 66 and owns almost 15% of Phillips’ available shares. His recent move has sparked a lot of questions regarding what Warren Buffet was thinking.

- Does he think the delayed effect of the export ban won’t hurt refining margins?

- Does he think crack spreads are on the rise for good?

- Or does he know something that I don’t?

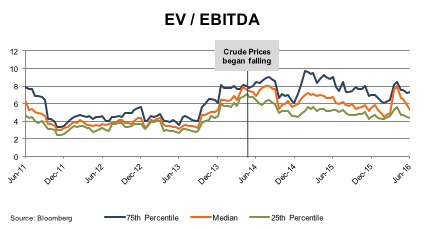

Since the fall of crude prices in 2014, valuation multiples have been through multiple cycles of compression and expansion. For refiners, low oil prices initially signal higher profit margins as refined oil product prices are not perfectly correlated with input prices. This is especially true for non-transportation refined product prices (such as asphalt, butane, coke, sulfur, and propane) whose prices are even less likely to respond to changes in the price of crude oil. Thus, upon the initial fall of prices, earnings increased because the price of refined petroleum products did not fall as quickly as the price of crude. Additionally, the low prices of crude oil and natural gas decrease refiners’ own operating expenses. Refining is itself an energy intensive process and natural gas is used to power refineries. By the fourth quarter of 2015, refiners’ margins began to compress as the price of refined petroleum transportation products started falling. Refiners’ profits continued to fall through the first quarter of 2016, but have since recovered as the price of refined products saw slight increases.1

Since the fall of crude prices in 2014, valuation multiples have been through multiple cycles of compression and expansion. For refiners, low oil prices initially signal higher profit margins as refined oil product prices are not perfectly correlated with input prices. This is especially true for non-transportation refined product prices (such as asphalt, butane, coke, sulfur, and propane) whose prices are even less likely to respond to changes in the price of crude oil. Thus, upon the initial fall of prices, earnings increased because the price of refined petroleum products did not fall as quickly as the price of crude. Additionally, the low prices of crude oil and natural gas decrease refiners’ own operating expenses. Refining is itself an energy intensive process and natural gas is used to power refineries. By the fourth quarter of 2015, refiners’ margins began to compress as the price of refined petroleum transportation products started falling. Refiners’ profits continued to fall through the first quarter of 2016, but have since recovered as the price of refined products saw slight increases.1 Buffet’s move gave downstream investors hope that refining profits won’t disappear altogether as the oil and gas market changes.

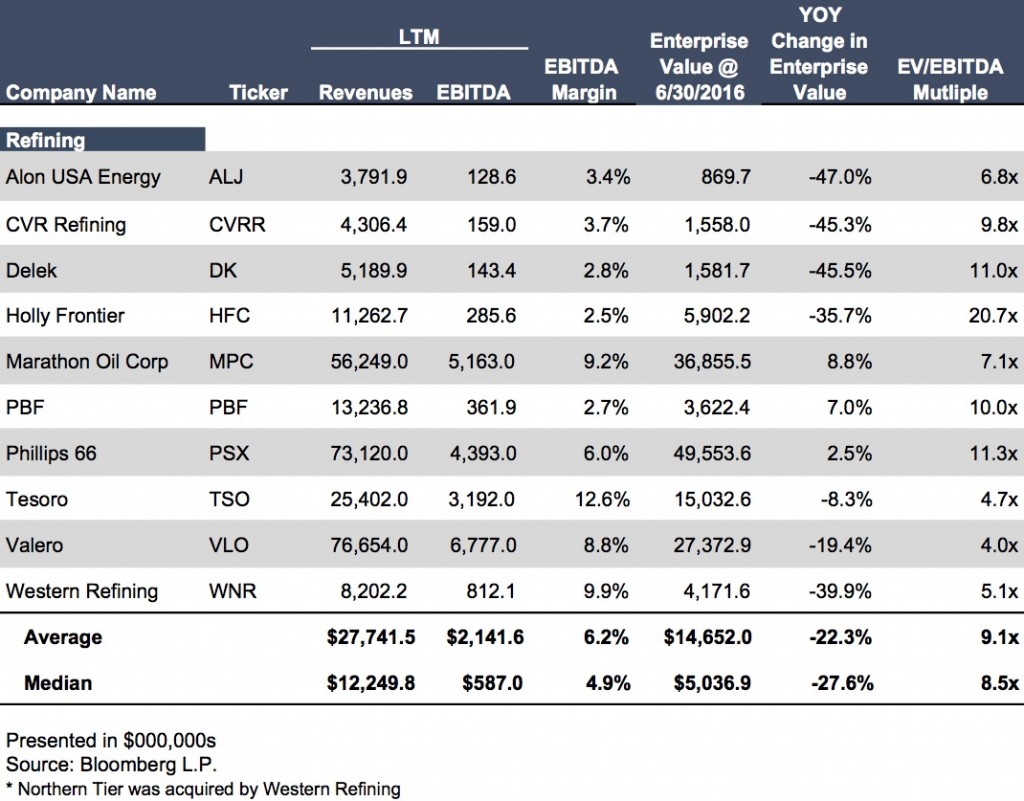

Refining and Marketing valuation multiples are somewhat inflated in the current market due to compressed profit margins. This tells us that the market views refiners’ decline in earnings as temporary. Phillips 66 profitability is in line with the group average, but has a higher EV/ EBITDA multiple of 11.3x whereas the average is 9.1x. This is due to their comparatively large size and depressed first quarter earnings. Additionally Phillips 66 operations are not entirely concentrated in the refining industry. Phillips has well developed midstream operations which they have expanded recently. Midstream operations are not as sensitive to changes in price and thus do not face the same risk of margin compression.

Warren Buffet is known for making long term investments. His position in Phillips 66 does not imply smooth sailing ahead for the refining sector. Refiners’ inputs and products are both commodities, which means that the price they pay for inputs and the prices they receive for their products are generally determined by the market and out of their control. However, demand for refined products increases with the strength of the economy, and Chairwoman Janet Yellen’s recent announcement that an interest rate hike is on the table predicts that a strong economy is in our future. The oil and gas industry is still surrounded with uncertainty, but refiners have generally proven to be resilient through the oil market downturn. Despite the uncertainty, we can find some comfort from Warren Buffets recent investment decision.

I know that I will find the best food on back streets, in shacks in the Lowes parking lot, and in basements downtown, but reassurance is comforting. When I ask myself what would Warren Buffet do … I think he would eat fried chicken.

Buffet’s move gave downstream investors hope that refining profits won’t disappear altogether as the oil and gas market changes.

Refining and Marketing valuation multiples are somewhat inflated in the current market due to compressed profit margins. This tells us that the market views refiners’ decline in earnings as temporary. Phillips 66 profitability is in line with the group average, but has a higher EV/ EBITDA multiple of 11.3x whereas the average is 9.1x. This is due to their comparatively large size and depressed first quarter earnings. Additionally Phillips 66 operations are not entirely concentrated in the refining industry. Phillips has well developed midstream operations which they have expanded recently. Midstream operations are not as sensitive to changes in price and thus do not face the same risk of margin compression.

Warren Buffet is known for making long term investments. His position in Phillips 66 does not imply smooth sailing ahead for the refining sector. Refiners’ inputs and products are both commodities, which means that the price they pay for inputs and the prices they receive for their products are generally determined by the market and out of their control. However, demand for refined products increases with the strength of the economy, and Chairwoman Janet Yellen’s recent announcement that an interest rate hike is on the table predicts that a strong economy is in our future. The oil and gas industry is still surrounded with uncertainty, but refiners have generally proven to be resilient through the oil market downturn. Despite the uncertainty, we can find some comfort from Warren Buffets recent investment decision.

I know that I will find the best food on back streets, in shacks in the Lowes parking lot, and in basements downtown, but reassurance is comforting. When I ask myself what would Warren Buffet do … I think he would eat fried chicken.

End Note

- The refiner marker margin (RMM) is a general indicator, calculated quarterly by British Petroleum, which shows the estimated profit refiners earn from refining one barrel of crude.